Liability Insurance for Guided Tour Companies

Protecting Guided Tour Companies on Land, Sea or Air

New York City has always been a center of attraction — last year was no exception. In 2017, the City welcomed a record 62.8 million visitors in 2017, an increase of 2.3 million tourists over 2016. Of those, 49.7 million were domestic and 13.1 million were international visitors. That’s great news for the Big Apple, and equally good news for guided tour companies that show these visitors a good time. Take the famous Circle Line Sightseeing Cruise around Manhattan Island, or the hop-on, hop-off, open-air bus tours, or walking tours — not to mention the new guided bike and Segway tours.

Of course, Washington, DC, Chicago, Las Vegas, and other major cities have their fair share of guided tours — whether by land, water or helicopter. After all, there’s a lot to see in this great country of ours. What do these guided tours have in common? The potential for great profits — and risk.

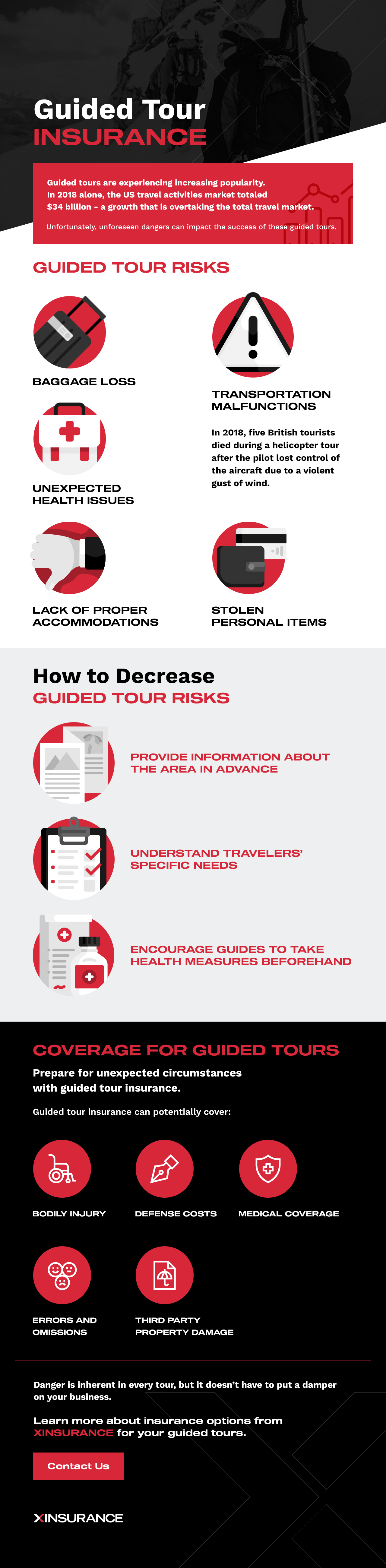

Guided Tour Risks

What are some of the most common risks associated with guided tours?

Baggage loss can be an inconvenience at best and dangerous at worst if your clients are carrying important information or medication in their luggage. Transportation malfunctions are also a risk to consider.

Consider the helicopter crash that killed four people on a Grand Canyon helicopter tour. In one case in 2018, five British tourists died during a helicopter tour after the pilot lost control of the aircraft thanks to a violent gust of wind. Or the city sightseeing, the open-air tour bus that careened out of control in San Francisco a few years ago and injured four.

You may also run into unexpected health issues or — depending on your location and the destination of your tour — a lack of proper accommodation, leaving you out in the cold. Finally, there is always the risk of stolen personal items. While no one will care about a t-shirt or a pair of shoes, if their money or passport goes missing, it can be a massive problem.

How to Decrease Guided Tour Risks

What can you do to decrease these risks on your guided tours?

Make sure you provide information about the area you’re traveling to in advance. We all love the idea of booking a trip or a tour on a whim, but it is essential that your clients know what they’re getting into before they pay for their tour. On your end, you also need to understand your travelers’ specific needs before they join the tour. You don’t need to be invasive with your questions but you do need to know anything that could potentially put them at risk during the tour.

Encourage your travelers to take health measures before they arrive. This could be as simple as taking Dramamine if they’re prone to motion sickness or as complex as necessary vaccinations before they arrive if they’re traveling from a different country.

Finally, you’ll need to obtain guided tour insurance to protect both you and your clients in the event of an incident.

XINSURANCE

XINSURANCE

If you’re offering guided tours, you should always be prepared for the unexpected. One of the best ways to do that is to obtain guided tour insurance. Danger is inherent in every tour, but it doesn’t have to put a damper on your business. Learn more about guided tour insurance options from XINSURANCE for your business and what insurance tour operators need.

XINSURANCE is powered by Evolution Insurance Brokers, an insurance brokerage. XINSURANCE provides customized specialty insurance solutions for ever-changing risks and liability issues, including property and casualty insurance — and Tour Operator Liability Insurance for Guided Tour Companies. We’ll even defend you in the event you are named in an incident, claim or lawsuit.

XINSURANCE provides an all-in-one approach that allows business owners to have broader coverage, up to $20 million limits with higher limits available through reinsurance partners, flexible underwriting, risk management expertise, extraordinary claims results, and a partnership approach.

With XINSURANCE, guided tour companies can rest assured they’ll be around to welcome millions of more visitors to their great city. Contact XINSURANCE today to see how we can help you protect your business as well as your clients moving forward.

Get A Quote Today!

You can start the quote process by filling out the form at the top of this page. Once you are finished, we will have an underwriter contact you about the quote request and discuss your insurance needs. Get started today!

Last updated on March 10, 2021.

Rick J. Lindsey hails from Salt Lake City, Utah. He began working in the mailroom of his father’s Salt Lake City insurance firm, getting his introduction to the business that became his lifelong career. Rick J. Lindsey quickly rose through the ranks while working in nearly every imaginable insurance industry job. As an entrepreneur, specialty lines underwriter, claims specialist, risk manager, and a licensed surplus lines broker, Rick J. Lindsey is highly skilled in all levels of leadership and execution. As he progressed on his career path, Rick J. Lindsey discovered an urgent need for insurers willing to write policies for high-risk individuals and businesses. He was frequently frustrated that he could not provide the liability protection these entities desperately needed to safeguard their assets. He also formed the belief that insurance companies acted too quickly to settle frivolous claims. Rick J. Lindsey decided to try a different approach. He started an insurance company and became the newly formed entity’s CEO. This opportunity has enabled Rick J. Lindsey to fill a void in the market and provide a valuable service to businesses, individuals, and insurance agents who write high-risk business. XINSURANCE also specializes in helping individuals and businesses who live a lifestyle or participate in activities that make them difficult for traditional carriers to insure. If you’ve been denied, non-renewed, or canceled coverage, don’t give up quite yet. Chances are XINSURANCE can help.

XINSURANCE

XINSURANCE