Cruise with peace of mind - golf cart insurance solutions for businesses and individuals

Whether you drive a golf cart in your local neighborhood, own a golf cart rental service, use golf carts as a shuttle service, etc., insurance coverage is a must. Golf carts are used all over the place, including neighborhoods, college campuses, senior communities, hotels, and airports. Make sure you’re covered with liability insurance for your golf cart.

The Importance of Golf Cart Insurance

Golf cart liability insurance is important for several reasons. First and foremost, it provides financial protection in the event of an accident, incident, claim, or lawsuit involving your golf cart. Without liability insurance, you could be held responsible for any damages or injuries caused by your golf cart, which can be financially devastating to you or your business.

Golf cart insurance is needed because accidents can happen, regardless of how careful you are as a golf cart driver or business owner. Whether it’s a collision with another vehicle, property damage, or injury to third parties, the costs associated with these incidents can be substantial. Liability insurance helps cover these expenses, including medical bills, property repairs, legal fees, and potential settlements or judgments.

XINSURANCE offers a specialized solution for those who may have difficulty obtaining coverage elsewhere, providing comprehensive, customizable, and reliable insurance protection for your peace of mind.

Who We Provide Golf Cart Insurance Solutions For

- Golf Cart Owners

- Golf Cart Rental Companies

- Transportation Services

- Golf Courses

- Resorts and Hotels

- Event Venues

- Security Services

- Recreation Facilities

- Industrial Sites

- And More!

Coverage Options for a Golf Cart Insurance Policy

Commercial General Liability

Provides coverage for injuries and property damage sustained by third parties.

Auto Liability

If your golf cart is “street legal,” this protection covers accidents that occur during road use.

Guest Passenger Liability

This form of liability coverage pays the medical expenses of passengers riding in the operator’s golf cart stemming from an accident that’s the operator’s fault.

Physical Damage

Provides protection against damage to the insured vehicle(s). This coverage can include collision coverage, which pays for damages caused by collisions with other vehicles or objects.

Commercial Auto*

Provides auto liability coverage for your company-owned or personally-owned vehicle primarily used for business purposes. Learn more.

*Available in most states

Equipment Coverage

Coverage for equipment, including rentals, used on the job in case of malfunctions or theft.

Personal Liability

Personal liability protection in the event of an accident and a claim is made against you. Learn more.

Premises Liability

Protects against claims for slips, trips, and falls on the property due to negligence.

Professional Liability

Coverage for claims regarding negligent acts and more. Learn more.

Property Coverage

Covers the building and its contents from weather-related risks, vandalism, theft, and more. Learn more.

Special Events Liability

Covers bodily injury to a guest and property damage to the venue (such as the building or its equipment) for private and public events. Learn more.

TRU Umbrella

Additional coverage to fill the gaps and exclusions in your existing policy. Learn more.

How To Get A Quote

Request Your Quote

Click the button below to get started on your quote

Specify Your Needs

We’ll schedule a call with you to consult on your needs, and collect more details

Get Your Custom Quote

We’ll use all the information provided to craft a highly personalized quote to address all of your specific insurance needs in one comprehensive policy

Learn More About Golf Cart Insurance

What Are The Risk of Golf Carts?

Golf carts come with risks that individuals and businesses should be aware of. The most common risks include accidents causing injuries, overturned carts due to reckless driving or uneven terrain, pedestrian hazards, insufficient maintenance leading to unsafe conditions, and improper loading or cargo handling affecting stability and maneuverability. To mitigate these risks, operators should prioritize safety, follow guidelines, receive proper training, and adhere to local regulations associated with golf cart usage.

What Coverage Do I Need for My Golf Cart Insurance Policy?

The type of insurance coverage needed for your golf cart or business will depend on your unique circumstances. XINSURANCE does not provide a cookie-cutter policy that applies to everyone. Instead, we talk to you and learn more about you and/or your business. We then come up with an insurance solution that provides customized coverage based on your needs. This all-in-one approach allows you to pick which coverages you want to have on your insurance policy.

To see what coverage options are available, scroll up to our Coverages section.

Can I Be Insured if I've Been Dropped or Rejected by an Insurance Company?

Yes, XINSURANCE can help you even if you’ve been declined, canceled, or non-renewed by an insurance company. We step in to provide an insurance solution when others can’t or won’t.

Why Should I Have Liability Insurance For My Golf Cart?

You need liability insurance for your golf cart or your business to help protect you when things go wrong. In life, you will learn how good your insurance partner is when what can happen does happen. XINSURANCE stands by your side when an accident, incident, claim, or lawsuit occurs. Having golf cart liability insurance can protect you from significant financial loss and can be the difference between staying in business and closing your doors. In some places, golf cart insurance may be required.

Recreational Vehicle Insurance

Have more toys than just a golf cart? We can provide insurance solutions for other recreational vehicles such as ATVs, snowmobiles, jet skis, aircraft, boats, and more!

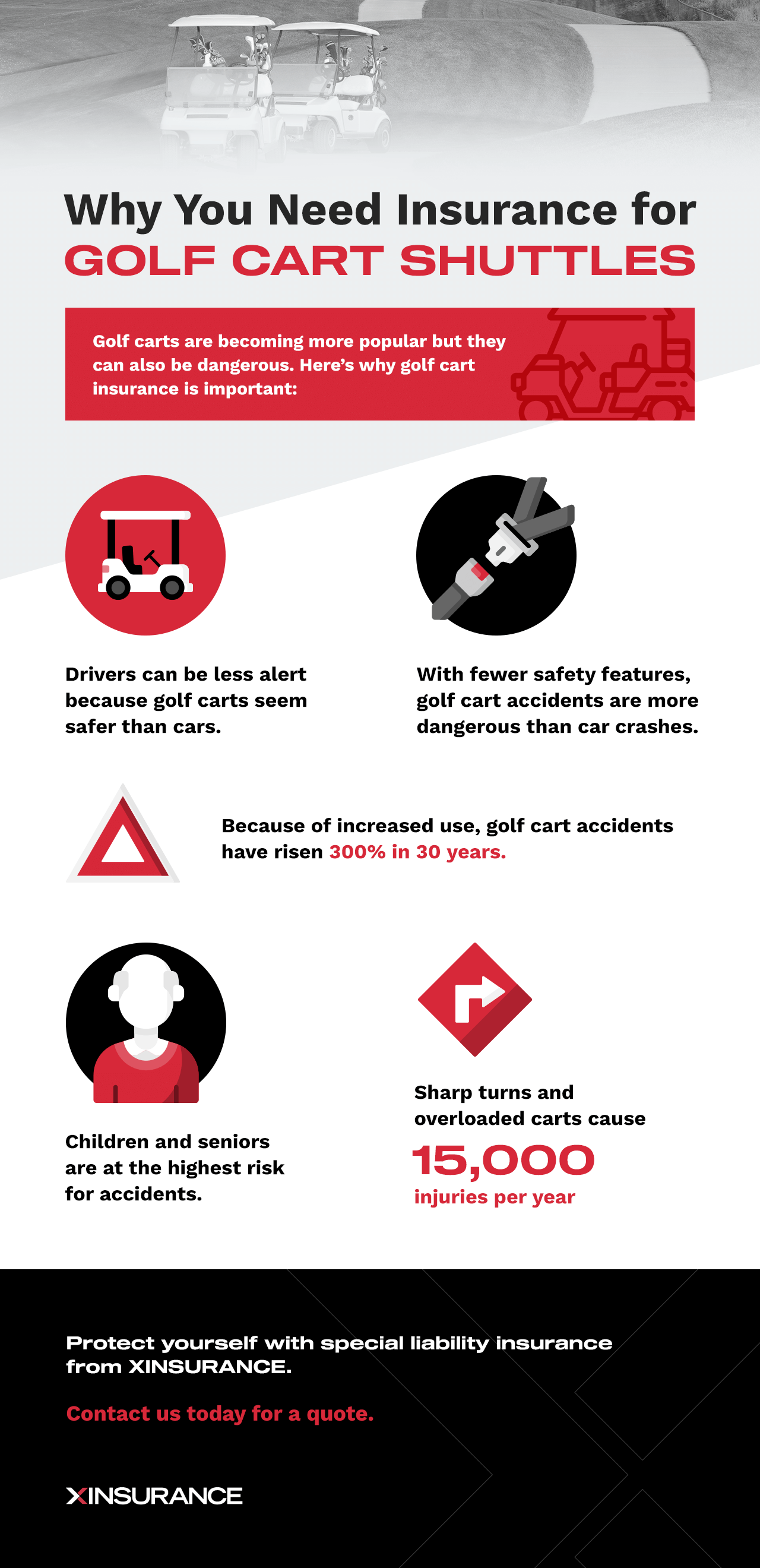

Know the Facts

40% of golf cart accidents involve a person falling out of the cart and 10% of accidents involve rollovers.

Small children and teenagers account for almost 1/3 of all golf cart-related injuries and accidents.

Each year in the US, approximately 15,000 golf cart-related injuries require emergency room treatment.

What our clients say

Your Trusted Team For Tackling the Unexpected

Fighting for You is What We do Best

At XINSURANCE, we believe in taking an active role in defending the interests of our customers. When an insured is facing challenges such as frivolous lawsuits or unfounded charges, we take pride in staying by their side.

Unique Requirements are Our Specialty

XINSURANCE specializes in covering the extraordinary cases that other agents lack expertise in. If you need something insured and can’t find a policy for it anywhere else — chances are our team will know exactly how to get you coverage for it.

Built-For-You Flexibility & Dedicated Support

The XINSURANCE approach to coverage is anything but “one size fits all”. Our specialty insurance experts work one-on-one with you to fully understand your circumstances, insurance needs, and high-risk areas up front. This means that by the time your policy is issued, we're fully prepared to support you through the worst-case scenarios — not drop you when an incident, claim, or lawsuit occurs.

More of Your Coverage - All In One Place

Though your policies won’t be “one size fits all,” XINSURANCE does take an all-in-one approach to insurance. This means that instead of buying several policies, we’re able to offer coverage solutions for your various needs all in one plan.

What You Can Expect From Our Team

Infographic on Why You Need Insurance for Golf Cart Shuttles

If an accident occurs, the injured party could decide to sue. A legal judgment or claims settlement could cost you thousands or millions of dollars.

All-in-one golf cart shuttle insurance from XINSURANCE can pay for injuries and property damage sustained by third parties up to your policy’s limits. If your case goes to court, your plan can also cover your legal expenses. It’s the most practical and cost-effective way to protect your assets.