Insurance For the Aquatic Industry

Specialty insurance solutions tailored to your unique needs.

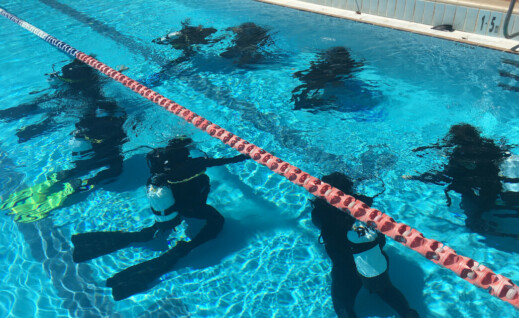

Get StartedDive deep into specialty liability coverage with XINSURANCE.

We offer the flexibility and personalization you or your business needs to thrive amidst industry-specific risks.

The Importance of Insurance in the Aquatic Industry

Aquatic professionals are in the business of ensuring others are safe and sound in the water. The Centers for Disease Control and Prevention (CDC) puts it this way: “From aquatic facility designers to lifeguards, aquatic professionals are the first line of defense against illness and injury at public aquatic venues.” There are plenty of risks and challenges that the industry faces. That is why XINSURANCE provides solutions for specialty liability insurance for the aquatic industry, including businesses and individuals.

It is essential that aquatic professionals and businesses work with an insurance partner that has their back. XINSURANCE is committed to protecting lifeguards, volunteers, instructors, businesses, and everyone else in the aquatic industry with customized coverage solutions that provide peace of mind.

Who We Can Help

- Aquatic Centers

- Aquatic Techs

- Business Owners

- Instructors/Coaches

- Lifeguards

- Pools

- Waterparks

- Recreation Centers/Parks

- And More!

Coverages

Commercial General Liability

Provides coverage for injuries and property damage sustained by third parties.

Watercraft Liability

Protects against bodily injury or property damage caused to others while operating your boat or watercraft.

Professional Liability

Coverage for claims regarding negligent acts and more. Learn more.

Property Coverage

Covers the building and its contents from weather-related risks, vandalism, theft, and more. Learn more.

Commercial Auto*

Provides auto liability coverage for your company-owned or personally-owned vehicle primarily used for business purposes. Learn more.

*Available in most states

Personal Liability

Personal liability protection in the event of an accident and a claim is made against you. Learn more.

Active Shooter Liability

Liability protection in the event of an active shooting taking place on company property. Learn more.

Alleged Assault and Battery Liability

Coverage for claims against you regarding assault and/or battery.

Alleged Sexual Abuse and Molestation Liability

Coverage for claims against you regarding sexual abuse and/or molestation.

Communicable Disease Liability

This is a policy enhancement that provides coverage for negligent exposure to any Declared Pandemic Disease or Pathogen, including COVID-19. Learn more.

Directors and Officers (D&O) Liability

Protects people from personal losses if they are sued as a result of serving as a director or an officer of an organization. Learn more.

Inland Marine

Can provide physical damage protection for applicable equipment while it is being rented, stored, or transported. It can provide financial assistance in case of accidents, malfunctions, and limited theft coverage.

Premises Liability

Protects against claims for slips, trips, and falls on the property due to negligence.

Products Liability

Protects your business from claims that a product you made, sold, or distributed, caused third-party bodily injury or property damage. Learn more.

Riot and Civil Commotion Liability

Liability protection against claims made from a riot or civil commotion.

Special Events Liability

Covers bodily injury to a guest and property damage to the venue (such as the building or its equipment) for private and public events. Learn more.

TRU Umbrella

Additional coverage to fill the gaps and cover the exclusions in your existing policy. Learn more.

How To Get A Quote

Request Your Quote

Click the button below to get started on your quote

Specify Your Needs

We’ll schedule a call with you to consult on your needs, and collect more details

Get Your Custom Quote

We’ll use all the information provided to craft a highly personalized quote to address all of your specific insurance needs in one comprehensive policy

FAQs About Insurance for the Aquatic Industry

What are the risks of water-based activities?

Aside from birth defects, unintentional drowning is the leading cause of death for children under the age of four; it is the second leading cause for children under age 14, and the fifth leading cause overall.

But there are other things that can happen in the pool, lake, or hot tub:

- Non-Fatal Drowning: According to the Centers for Disease Control and Prevention, “For every child who dies from drowning, another five receive emergency department care for nonfatal submersion injuries.” Those injuries can lead to permanent brain damage that may include memory issues or the loss of the ability to perform the basic functions of daily life.

- Chemical Injuries: There are about 3,000-5,000 emergency room visits every year that are related to pool chemical injuries—about half of those injured are under age 18. This may occur because of improper amounts of chemicals in the water or because of an individual’s sensitivity to a particular chemical.

- Waterborne Illness: Chlorine-tolerant parasites can infect hundreds or even thousands of swimmers.

- Public Health Concerns: An infected swimmer’s saliva, blood, or urine could get in the water. Birds and other animals may also contaminate the water with feces.

- Faulty Equipment: Broken or malfunctioning water toys, scuba gear, or other equipment could lead to user injury.

What is aquatic industry insurance?

Aquatic industry insurance is a specialized form of liability coverage designed to protect businesses and professionals operating in environments involving water activities, marine enterprises, or watercraft, against risks unique to their industry.

Why do I need liability insurance in the aquatic industry?

Some injuries are the result of user error or a random accident for which no one could be blamed; in other cases, the injured person may file a lawsuit against your business or employees, accusing you of improper supervision or instruction, problems with equipment, an unsafe or unclean environment, and more.

Liability insurance for aquatic professionals is one way to protect yourselves and ensure you can manage legal bills and more in the event of a lawsuit.

You may choose to add commercial property liability coverage if you own the pool, building, or property, as well as professional, participant, and general liability so you are thoroughly covered for a wide range of potential occurrences. We can work with you to customize your coverage to best suit your unique needs.

Can I be insured if I've been dropped or rejected by an insurance company?

Yes, XINSURANCE can help you even if you’ve been declined, canceled, or non-renewed by an insurance company. We step in to provide an insurance solution when others can’t or won’t.

Is watercraft liability insurance mandatory?

In many jurisdictions, watercraft liability insurance is mandatory for operating commercial vessels or watercraft as it protects against liabilities arising from bodily injuries or property damage caused by your watercraft.

How much does aquatic industry insurance cost?

The cost depends on several factors, including the type and size of the operation, the value of the insured assets, risk exposure, coverage limits, claims history, and more. Each policy is tailored, so costs can vary significantly. It’s best to contact us and tell us more about you and your insurance needs so we can provide a personalized quote.

Getting Liability Insurance for Aquatic Professionals

Whether you’re involved with aquatic management, aquatic programming, aquatic operation, aquatic maintenance, aquatic facility design, aquatic centers, private swim lessons, lifeguard classes, or scuba diving, we got you covered! We can help all types of businesses and individuals, no matter the situation.

What our clients say

Your Trusted Team For Tackling the Unexpected

Fighting for You is What We do Best

At XINSURANCE, we believe in taking an active role in defending the interests of our customers. When an insured is facing challenges such as frivolous lawsuits or unfounded charges, we take pride in staying by their side.

Unique Requirements are Our Specialty

XINSURANCE specializes in covering the extraordinary cases that other agents lack expertise in. If you need something insured and can’t find a policy for it anywhere else — chances are our team will know exactly how to get you coverage for it.

Built-For-You Flexibility & Dedicated Support

The XINSURANCE approach to coverage is anything but “one size fits all”. Our specialty insurance experts work one-on-one with you to fully understand your circumstances, insurance needs, and high-risk areas up front. This means that by the time your policy is issued, we're fully prepared to support you through the worst-case scenarios — not drop you when an incident, claim, or lawsuit occurs.

More of Your Coverage - All In One Place

Though your policies won’t be “one size fits all,” XINSURANCE does take an all-in-one approach to insurance. This means that instead of buying several policies, we’re able to offer coverage solutions for your various needs all in one plan.